INDICATA Market Watch: Online B2C used BEV sales flatline

Online B2C used BEV sales flatline

Europe is seeing some crazy economic changes currently, from rising inflation, high energy costs, soaring interest rates all resulting in a cost-of-living crisis and the Netherlands is no exception. Where it is different is the dynamics of its online B2C used car market which is showing levels of robust steadiness other markets could only wish for.

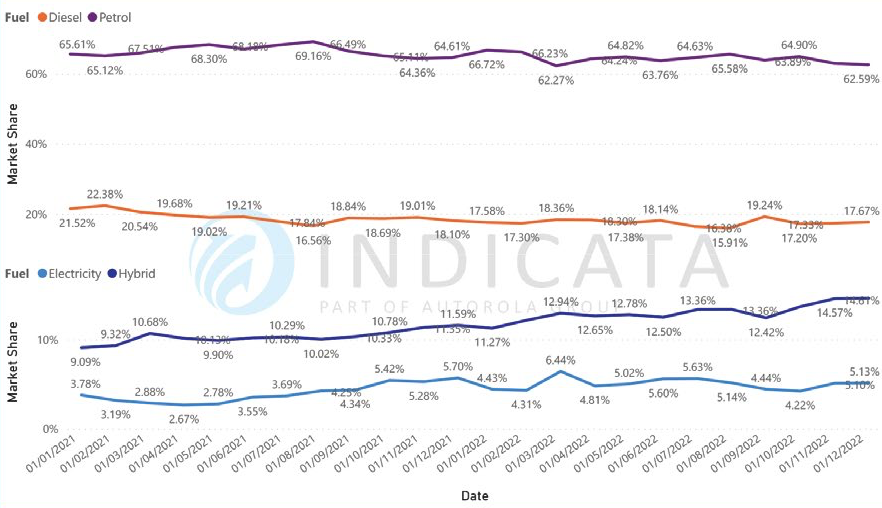

Online B2C used petrol and diesel car sales lost a little market share to hybrids which saw its market share hit 14.61% in December a 3.02 percentage point increase year-on-year. What will be more concerning for some manufacturers and governments is the trend over the last year for BEVs. Online B2C used BEV sales in December were 5.13%, one of the best market shares in Europe, but just a year earlier BEV market share in December 2021 was 5.7%, peaking at 6.44% in March.

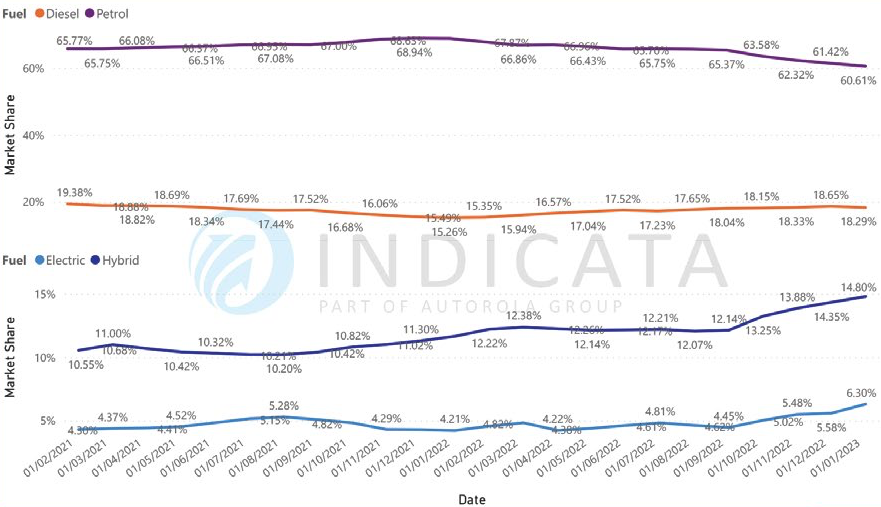

Equally concerning is the trend in stock levels which is showing online B2C used petrol share of stock levels falling year-on-year going into January 2023, used diesels seeing a 19.9% increase year-on-year and used hybrids now taking 14.8% of total stock a 31.0% YoY increase.

The highest increase though is in levels of online B2C used BEVs which now represent 6.3% of available stock, a 46.9% increase year-on-year.

With stock levels rising and sales flatlining it means stock turn is inevitably rising sharply for BEVs. BEV Market Days’ Supply, i.e. the number of days’ worth of stock to cover sales at the current sale run rate, now stands at 103 days going into January far worse than the 56 days seen at the beginning of August 2022.

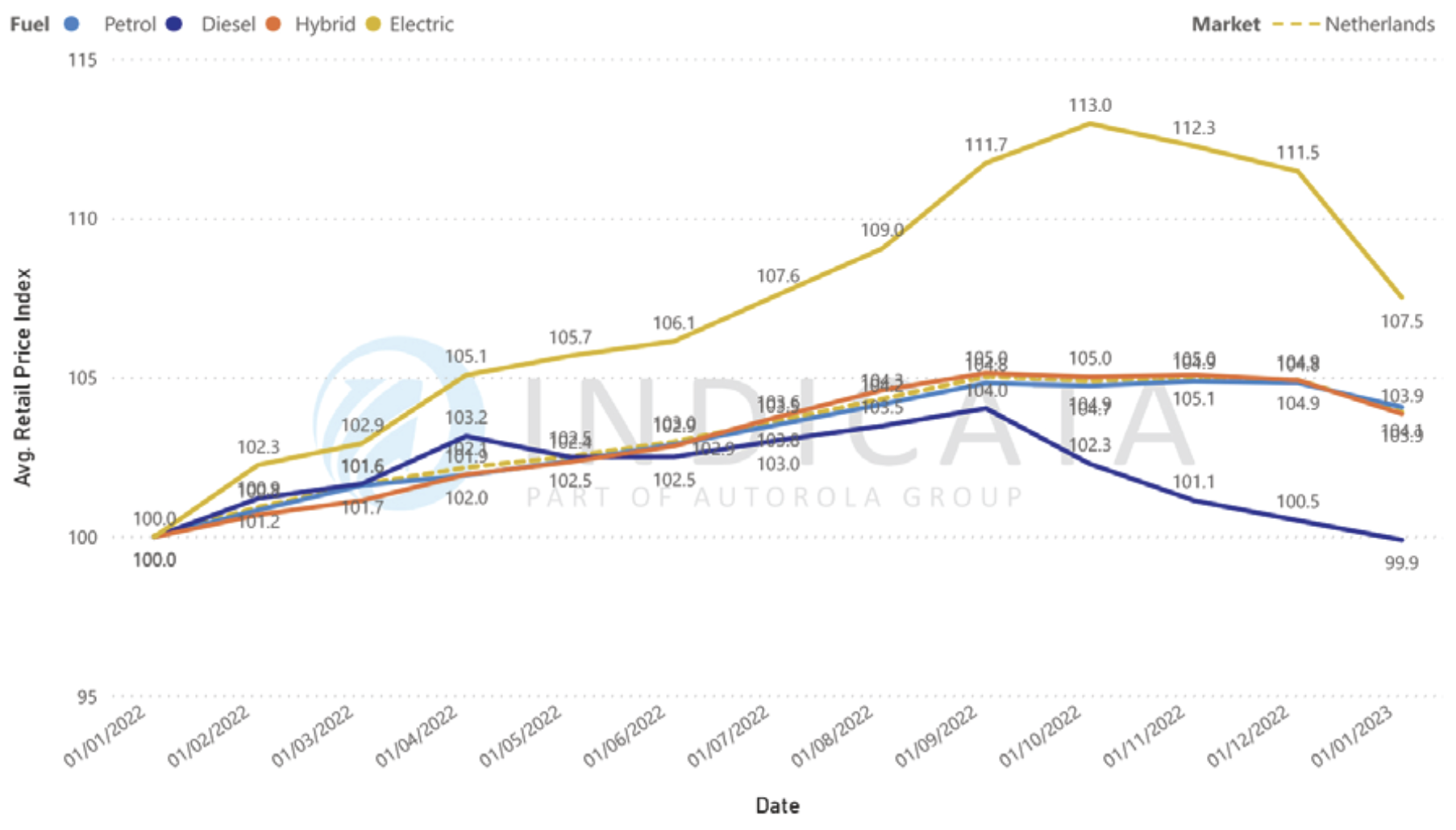

Our online B2C used car retail price index is based on a consistent pool of vehicles indexed against January 2022 and would normally see a lifecycle driven downward curve in average prices. Average prices in the Dutch market have now been relatively stable for the last five months but are now starting to reduce. Prices going into January are 1.0 percentage points lower than at the start of December although they are still 3.9pp higher than at the start of 2022 and 7.0pp above the end of 2021.

For more information, download the latest Market Watch or apply for a demo.

Background

On the 24th of March INDICATA published its first White Paper “COVID-19 To what extent will the used car market be affected (and how to survive)?”. This document explored:

Early market trends - Initial impact of the virus and the social distancing measures implemented.

Market scenarios – A range of impacts based on infection rate development and historical market data.

Mitigation – Risk assessment by sector coupled with potential corrective actions.

We committed to keeping the market updated with live data, volume, and price, to keep abreast of the fast-moving environment.

As such we are pleased to announce “Indicata Market Watch”.

How do we produce our data?

Indicata analyses 9m Used Vehicle adverts across Europe every day. To ensure data integrity, our system goes through extensive data cleansing processes.

The Sales (deinstall data) in this report are based on advertisements of recognised automotive retailers of true used vehicles. As such, it does not include data related to private (P2P) advertisements.

Where an advert is removed from the internet, it is classified as a “Sale”.

Appendix

INDICATA Market Watch January 2023 (The Netherlands)

INDICATA Market Watch January 2023 (Europe)