INDICATA Market Watch: Strong demand for used cars is driving growth. Retail prices are not rising along

European dealer stock levels are under pressure, increasing stock in The Netherlands

Executive Summary European Market

> Pent-up demand had fuelled European growth since lockdowns were lifted, yet rates of growth appeared to be slowing. Indeed, in August the UK market shrank 3.3%.

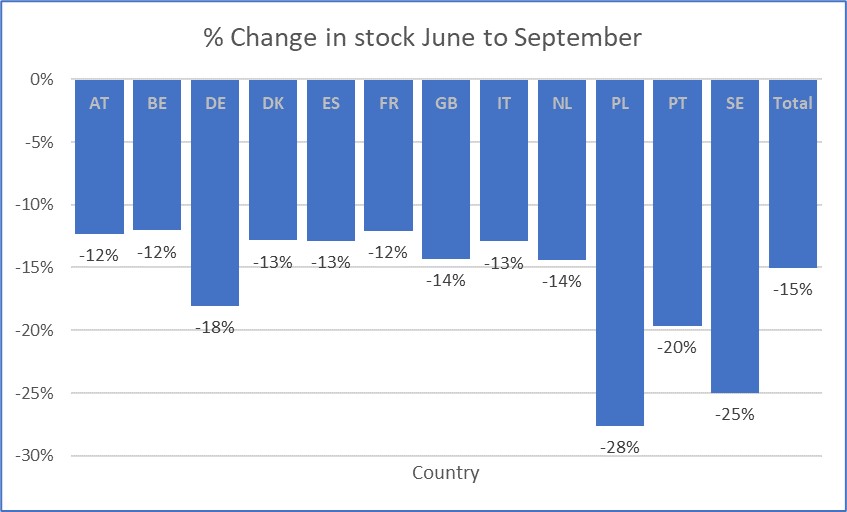

> However, rather than pent-up demand running out, this slowing appeared to be due to supply constraints with dealer stock falling 15% from June to September.

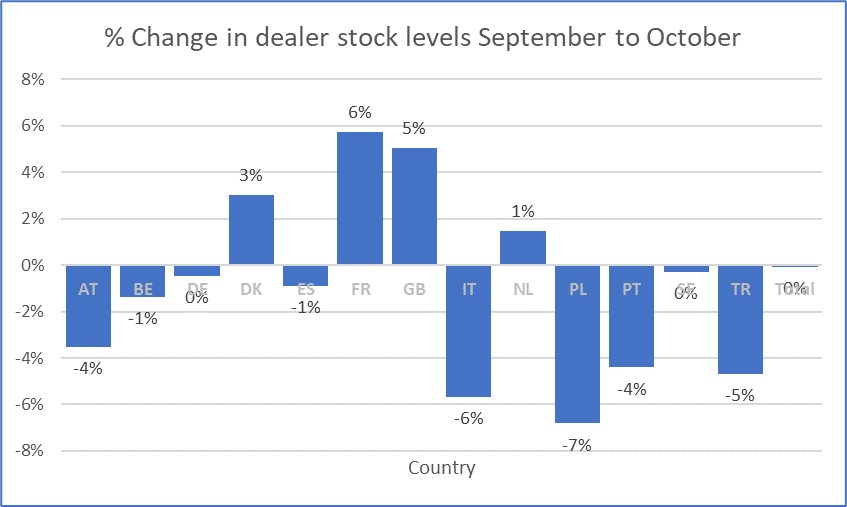

> September the market jumped 18% YOY suggesting that if pent-up demand was ending, it was being replaced by underlying demand.

> Equally, the constant squeeze on dealer stocks abated, and indeed in key markets stocks were up (UK 5%, France 6%) thus allowing for further volume growths.

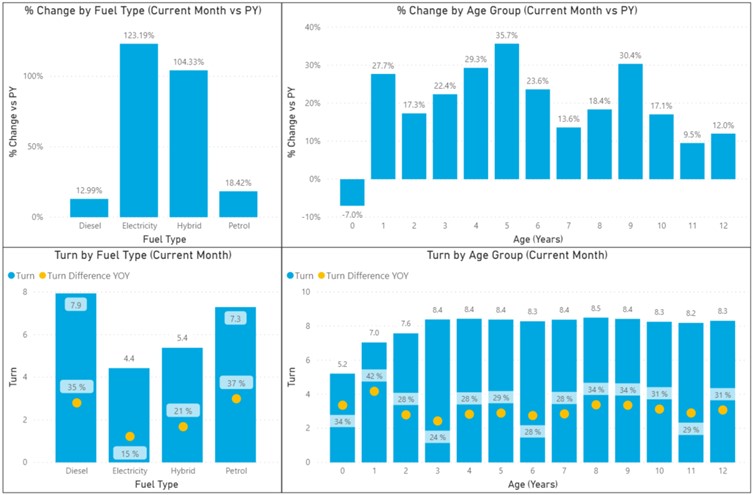

> Environmental powertrain (BEV and Hybrid) volumes continue to increase significantly (September YOY up 123% and 104% respectively).

> However, whilst marginally higher, stock turns of environmental cars are well below the market norm (4.4x and 5.4x respectively) suggesting the growth is driven by oversupply as much as underlying demand. Accordingly prices are less firm.

> Sub 1 year old volumes are down significantly (7.0%), but their level of stock turn increase year on year (34%) suggests that low volumes are still driven by lack of supply with limited volumes of demonstrators coupled with OEM’s not forcing the market with 0Km or Pre-registered cars.

> Overall prices remain firm when we would expect a small drift down in our price index suggesting that the market remain in balance and underlying demand is still exceeding any supply increases.

> Although there are signs that Covid levels are increasing and a second wave appears due, in September at least, demand remains strong, supply remains balanced and prices are firm.

European markets - Pend up demand has ended - now is real demand!

Bron: INDICATA Market Watch

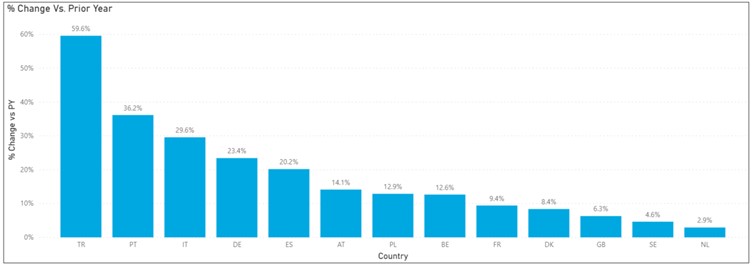

Since the end of lockdowns, the European market has shown significant signs of pent up demand and year on year growth. That said, the rate of growth was beginning to slow (from 13.2% in June to 10.3% in August). We need to assess if the slowing growth is pent up demand finally being satisfied or is it a supply shortage holding the market back?

In September, the European used car market took another leap forward with year on year volumes up significantly at 18.4% growth. Most major markets are moving forward. Even the UK market which had shown some level of reduction in (August down 3.3%) has now jumped up as supply constraints have eased. Thus, to understand the supply demand relationship better, we have updated our Market Watch analysis to now look at both volumes and now market stock turns. If volumes are down, but stock turn are up, then it is a real sign of a market that is supply constrained.

Real trends between fuel types and vehicle ages

Bron: INDICATA Market Watch

Previously we had reported the strong volumes growth in more environmental powertrains. In September this trend continues. However, overlaying turn data, shows that BEV’s and Hybrids are in far freer supply than their ICE equivalents which are indeed being held back as a result of supply shortages. Diesels are in short supply with Stock turns straining at 7.9 times, up 35% year on year. Petrol vehicles are also under pressure at 7.3x turns up 37% YOY.

Conversely, whilst still marginally up, BEV stock turns languish at 4.4x and Hybrids at 5.4x. It is this free supply that has allowed such strong volumes growth. Indeed, with such low turns it could be argued that these markets are in oversupply. However, the main ICE market is clearly in short supply and volumes would be even higher should stock be available. Accordingly, we are seeing far greater stability in pricing in the Petrol and Diesel segments than we are seeing in the BEV market.

Bron: INDICATA Market Watch

Dealer stock levels up to 1st September have been under significant pressure, down 15% vs June levels.

Over September total levels remained flat, however there were some notable differences between countries. France, UK and The Netherland and Denmark all saw an increase in dealer stocks. Notably in France and UK this has been combined with a significant uplift in sales volumes as supply eased (UK was down 3.3% in August and now is 6.3% up / France was only 1.5% up in August and now is 9.4% up in September).

Again this suggests markets that were deeply supply constrained.

Nederland - Ondanks sterke vraag naar occasions groeien retailprijzen niet mee

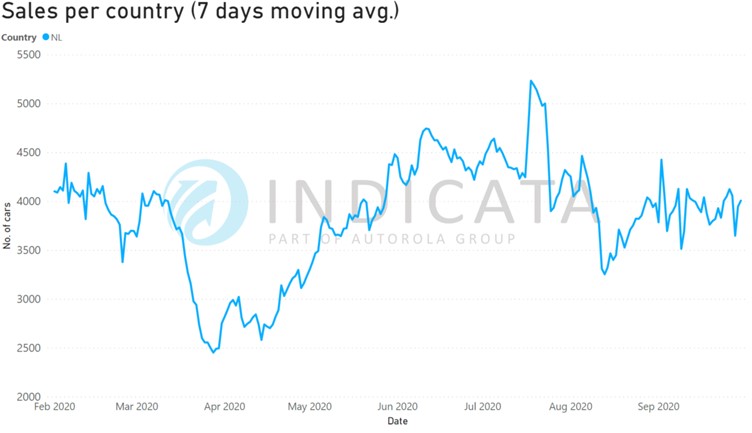

In juni 2020 kende Nederland een groei in occsasionverkoop van 20% ten opzichte van vorig jaar - een groei die in juli weer vertraagde tot 9,7% en in augustus tot 2,8%. In september kwam de groei nagenoeg op hetzelfde niveau als in augustus, namelijk tot 2,9%.

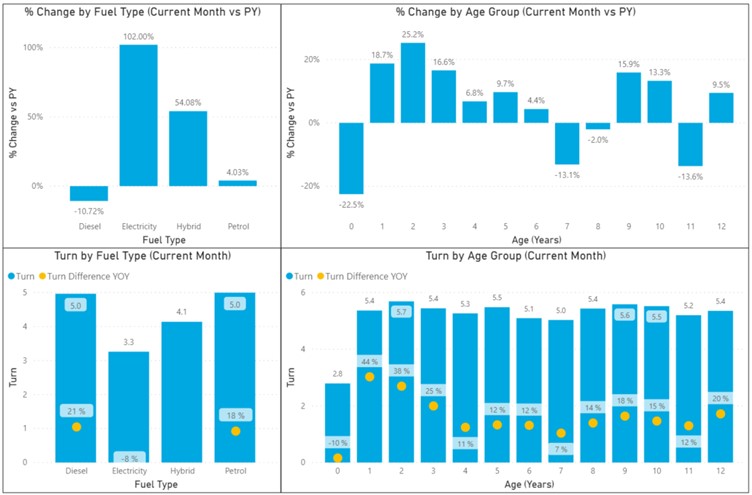

In het algemeen is in Nederland dezelfde trend te zien als in de meeste andere EU-landen, waar auto's met een benzine- of dieselmotor een hogere omloopsnelheid kennen dan auto's met een meer milieuvriendelijke aandrijflijn. Het aanbod op de occasionmarkt is daardoor wellicht beperkter.

Verkoop Europese occasionmarkt

Bron: INDICATA Market Watch

De omloopsnelheid van BEV's en hybrideauto's is daarentegen aanzienlijk lager, wat in combinatie met het toenemende aanbod voor een aanzienlijke groei van het volume heeft gezorgd (respectievelijk 102% en 54%). En de omloopsnelheid van elektrische auto's is zelfs gedaald ondanks de grotere volumes, wat suggereert dat het aanbod de vraag overstijgt.

De omloopsnelheid van auto's jonger dan 1 jaar is altijd lager dan die van andere leeftijdscategorieën, wat ook te zien is aan het ouder wordende aanbod van (in principe niet voor verkoop bestemde) demonstratieauto's. Het aanbod van auto's jonger dan 1 jaar is kleiner (-22,5%), wat logisch is gezien de afname van de verkoop van nieuwe auto's en 0 km-auto's, hoewel de 10% lagere omzet aangeeft dat de vraag ernaar ook niet heel groot is. De omloopsnelheid van 1 tot 3 jaar oude auto's is daarentegen opmerkelijk hoog (en nog altijd groeiende) en de toename in volume doet de markt opleven, ondanks het schrale aanbod.

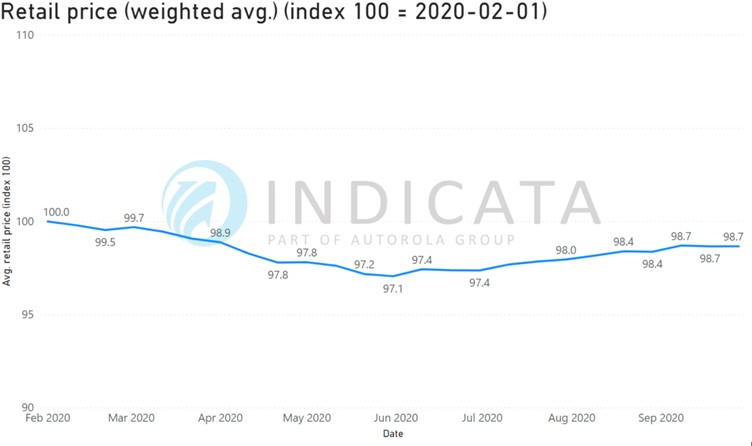

Het tekort in aanvoer is te zien aan de prijzen en de markt toonde ditmaal niet de gebruikelijke dalende trend vanaf juni (uitgaande van dezelfde groep auto's), maar bleef zeer stabiel en kende zelfs een lichte groei.

Bron: INDICATA Market Watch

INDICATA introduceerde Market Watch in april 2020, een informatiebron in twee varianten voor remarketing professionals, dat inzicht kan bieden bij het nemen van beslissingen met betrekking tot hun occasionbeleid. Dealers, OEM's en leasemaatschappijen kunnen zich aanmelden voor het gratis regelmatig verschijnende Market Watch pdf-bestand of de web-based rapportagetool via: indicata.nl

Over INDICATA

INDICATA is onderdeel van de Autorola Group en levert realtime waarden, business intelligence en analytische oplossingen ten behoeve van succesvol occasionbeleid in de automotive sector. Door realtime data van de occasionmarkt in 14 landen te verzamelen, te verwerken en te analyseren, wordt inzicht in vraag en aanbod, prijs- en marktdynamiek en voorraden gegeven. De data wordt niet alleen gebruikt om inzicht te krijgen in courantheid en prijsontwikkelingen, maar ook voor (rest)waarde-bepaling. indicata.nl

Over Autorola Group

Autorola Group, met hoofdkantoor in Denemarken, is wereldwijd actief op het gebied van online remarketing en ICT-oplossingen voor professioneel wagenparkbeheer in de Automotive. Er werken ruim 420 werknemers bij meerdere vestigingen in 19 landen, in Europa, Noord-Amerika, Latijns-Amerika en Oceanië. nl.autorolagroup.com

Persinformatie

Frank Tanke, Country Director Nederland, Dit e-mailadres wordt beveiligd tegen spambots. JavaScript dient ingeschakeld te zijn om het te bekijken., mobiel +31 (0)6 868 152 50

Bijlagen

Persbericht INDICATA Market Watch Oktober 2020_Nederlandse markt

INDICATA Market Watch European market, October 2020.pdf

INDICATA Market Watch Dutch market, October 2020.pdf